Quickbooks Independent Contractors – Managing finances as an independent contractor can be challenging. From tracking expenses to generating invoices and filing taxes, the need for streamlined, effective tools is essential. QuickBooks is one such tool that caters specifically to independent contractors, offering a suite of features designed to make financial management as seamless as possible.

In this article, we’ll dive deep into QuickBooks for independent contractors, covering its features, benefits, pricing, and where to buy it. Additionally, we’ll explore other top alternatives, make a detailed comparison, and answer the most common questions. Let’s get started!

Why QuickBooks is Ideal for Independent Contractors

Independent contractors often juggle multiple clients and projects, which makes tracking income, expenses, and time crucial for success. QuickBooks offers specialized features that address these needs, providing an all-in-one financial management solution.

Key Features of QuickBooks for Independent Contractors

- Expense Tracking

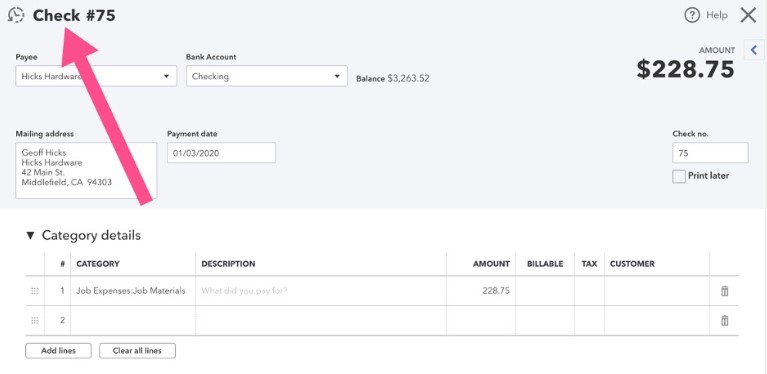

Automatically track your expenses by linking your bank account and credit cards. The tool categorizes expenses, helping contractors avoid missed deductions. - Invoicing

Create and send professional invoices within minutes. QuickBooks even offers automatic reminders to clients who haven’t paid yet! - Mileage Tracking

For contractors who frequently drive for work, QuickBooks’ mileage tracking is a lifesaver. The app tracks miles automatically and helps you claim deductions. - Tax Filing

QuickBooks simplifies tax preparation by organizing all your financial data in one place, making it easier to file taxes at the end of the year. - Time Tracking

Keep track of billable hours with the QuickBooks time-tracking feature. Perfect for freelancers who charge clients by the hour.

Real-World Product Alternatives to QuickBooks

While QuickBooks is a powerful tool, it’s important to consider other alternatives. Below are three top competitors that serve independent contractors:

1. FreshBooks

FreshBooks is another popular choice for independent contractors. It offers similar features like invoicing, expense tracking, and time management but stands out for its user-friendly interface.

| Feature | FreshBooks | QuickBooks |

|---|---|---|

| Invoicing | Yes | Yes |

| Time Tracking | Yes | Yes |

| Expense Tracking | Yes | Yes |

| Tax Filing | Limited | Full-featured |

| Price | Starting at $17/month | Starting at $15/month |

| Use Case | Best for freelancers who need simple, easy-to-use software | Best for contractors needing advanced tax features |

Pros:

- Simple, intuitive interface

- Great for small, service-based businesses

- Easy to learn

Cons:

- Limited tax features

- Fewer integrations compared to QuickBooks

2. Xero

Xero is a cloud-based accounting platform that offers a wide range of financial management tools. It’s highly customizable, making it an excellent choice for independent contractors with specific accounting needs.

| Feature | Xero | QuickBooks |

|---|---|---|

| Invoicing | Yes | Yes |

| Time Tracking | Yes | Yes |

| Expense Tracking | Yes | Yes |

| Tax Filing | Yes | Yes |

| Price | Starting at $13/month | Starting at $15/month |

| Use Case | Best for contractors looking for more customization | Best for contractors needing tax management tools |

Pros:

- Extensive customization options

- Great for scaling businesses

- Excellent third-party integrations

Cons:

- Steeper learning curve

- More expensive for advanced features

3. Wave

Wave is an ideal option for independent contractors on a tight budget. It offers essential features like invoicing and expense tracking for free!

| Feature | Wave | QuickBooks |

|---|---|---|

| Invoicing | Yes | Yes |

| Time Tracking | No | Yes |

| Expense Tracking | Yes | Yes |

| Tax Filing | Limited | Full-featured |

| Price | Free | Starting at $15/month |

| Use Case | Best for budget-conscious contractors | Best for full-featured financial management |

Pros:

- Free accounting features

- Perfect for small contractors or side hustles

Cons:

- No time-tracking feature

- Limited integrations and reports

Benefits of Using QuickBooks for Independent Contractors

1. Save Time with Automation

QuickBooks offers a range of automation tools, from automatic expense categorization to recurring invoices. These features save independent contractors hours of manual data entry.

2. Tax Deductions Made Simple

By tracking your expenses, QuickBooks ensures that you never miss a tax deduction. The software automatically categorizes expenses, ensuring you get every possible tax break.

3. Stay Organized

One of the biggest challenges for independent contractors is staying organized. QuickBooks integrates invoicing, expense tracking, and time tracking into one seamless platform.

4. Increased Cash Flow

With the invoicing feature, contractors can quickly create and send invoices, reducing the time it takes to get paid. The automatic reminders also help avoid late payments.

5. Mobile Accessibility

The QuickBooks mobile app allows you to track expenses, mileage, and more on the go. This is a huge benefit for contractors who are always on the move.

Use Cases: How QuickBooks Solves Common Problems

Problem: Disorganized Finances

Solution: QuickBooks organizes all your financial data in one place. Whether it’s invoices, expenses, or time tracking, everything is stored in an easy-to-navigate dashboard. This makes it easier to stay on top of your finances and avoid mistakes.

Problem: Missed Tax Deductions

Solution: By automatically tracking and categorizing expenses, QuickBooks ensures that independent contractors take advantage of every available tax deduction. The tax filing feature also helps ensure that you’re filing accurately and on time.

Problem: Late Payments from Clients

Solution: QuickBooks allows you to send invoices in just a few clicks and includes an automatic payment reminder feature. This reduces the chance of delayed payments and helps keep your cash flow steady.

How to Buy QuickBooks and Pricing

QuickBooks offers multiple pricing tiers depending on your business needs:

- Simple Start: $15/month

- Basic invoicing and expense tracking

- Essentials: $27/month

- Includes time tracking and bill management

- Plus: $42/month

- Best for growing businesses with up to five users

You can buy QuickBooks directly from the official QuickBooks website. For added convenience, click the button below to get started!

Frequently Asked Questions (FAQ)

1. Can QuickBooks help me file my taxes?

Yes, QuickBooks provides comprehensive tax filing tools for independent contractors, making tax season much less stressful.

2. Is QuickBooks worth it for independent contractors?

Absolutely! The features offered, such as expense tracking and invoicing, are essential for managing finances effectively as an independent contractor.

3. Does QuickBooks offer mileage tracking?

Yes, QuickBooks has a built-in mileage tracker that automatically tracks and logs your trips for tax deductions.

4. What’s the best alternative to QuickBooks?

FreshBooks and Xero are both excellent alternatives to QuickBooks, offering similar features with slight differences depending on your specific needs.

5. How secure is my data with QuickBooks?

QuickBooks uses advanced encryption and security measures to ensure your data is safe.

By using QuickBooks or one of its alternatives, independent contractors can save time, increase cash flow, and stay organized—ultimately helping them focus on growing their business.

Read More:

- Best Apps for Self-Employed: Streamline Your Workflow in 2024

- Best Apps for Independent Contractors in 2024: Boost Productivity & Manage Finances