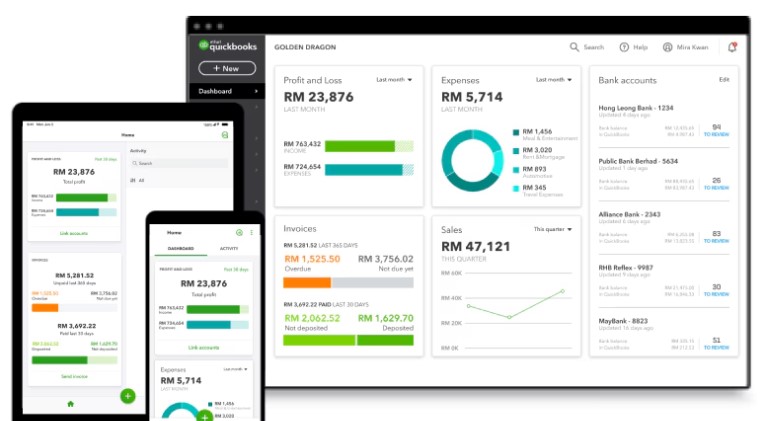

QuickBooks Features – If you’re managing a business, having the right accounting software is essential for staying organized, ensuring accurate bookkeeping, and making tax season less stressful. QuickBooks is one of the most widely used accounting platforms, with features that help small and medium-sized businesses (SMBs), freelancers, and self-employed professionals manage finances efficiently.

In this article, we’ll take a deep dive into the key features of QuickBooks, highlighting their benefits, use cases, and how they can solve common business challenges.

Why QuickBooks is Essential for Businesses

QuickBooks offers an all-in-one solution that simplifies accounting tasks, making it easier to track income and expenses, manage invoices, and even handle payroll. Whether you’re running a startup, managing a freelancing gig, or overseeing a growing business, QuickBooks has something to offer. Here are some of the key reasons why businesses trust QuickBooks:

- Automated financial processes for reduced errors.

- Real-time reporting for better decision-making.

- Easy tax preparation with integrated tax tools.

- User-friendly interface for all skill levels.

Top Features of QuickBooks in 2024

1. Invoicing and Payment Processing

One of the standout features of QuickBooks is its robust invoicing system. With QuickBooks, you can easily create professional, customized invoices and send them to your clients.

Key Features:

- Customizable Invoice Templates: Tailor your invoices to match your brand.

- Recurring Invoices: Automate regular invoices to save time.

- Payment Tracking: Monitor when invoices are sent, viewed, and paid.

- Multiple Payment Methods: Accept payments through credit cards, ACH transfers, and PayPal.

Benefits:

- Improved cash flow: Faster payments mean more liquidity for your business.

- Time-saving automation: Set up recurring invoices for repeat clients.

2. Expense and Income Tracking

QuickBooks offers an easy way to track both your income and expenses in one place. You can connect your bank accounts and credit cards directly to the software for automatic transaction import.

Key Features:

- Bank Syncing: Automatically import transactions from your bank accounts.

- Expense Categorization: Organize your expenses into categories for easier tracking.

- Receipt Management: Snap photos of your receipts and store them digitally.

Benefits:

- Accurate tracking: With real-time updates, you always know where your business stands.

- Easy tax preparation: Properly categorized expenses make tax time a breeze.

3. Payroll Management

For businesses with employees, managing payroll can be complex and time-consuming. QuickBooks simplifies the process with automated payroll features.

Key Features:

- Automated Payroll Processing: Set up payroll to run automatically.

- Tax Filing: Automatically calculate and file federal and state payroll taxes.

- Employee Benefits: Integrate with benefit providers for health insurance, 401(k) contributions, and more.

Benefits:

- Compliance: Avoid costly tax penalties by automating payroll tax calculations.

- Employee satisfaction: Ensure timely and accurate payments to your employees.

4. Inventory Management

If your business sells physical products, keeping track of inventory is crucial. QuickBooks helps automate this process by tracking stock levels and providing alerts when it’s time to reorder.

Key Features:

- Automatic Inventory Updates: Sync your inventory levels with sales orders and purchases.

- Inventory Tracking: Monitor stock across multiple locations.

- Reorder Alerts: Get notifications when stock levels are low.

Benefits:

- Improved cash flow: Avoid over-ordering and under-ordering stock.

- Better decision-making: Use inventory reports to make smarter purchasing decisions.

5. Tax Preparation and Filing

Taxes can be a daunting task for any business owner. QuickBooks simplifies the process by organizing all of your income, expenses, and deductions in one place.

Key Features:

- Tax Deduction Tracking: Automatically identify potential deductions.

- Quarterly Tax Estimates: Get estimates for quarterly taxes based on your income and expenses.

- Tax Filing Integration: Export financial data to TurboTax or other tax filing platforms.

Benefits:

- Stress-free tax season: Spend less time preparing your taxes.

- Maximize deductions: Avoid overpaying by accurately tracking deductible expenses.

Real-World Examples of QuickBooks Use Cases

Here are some examples of how QuickBooks can be used by different types of businesses:

1. Freelancers and Consultants

Freelancers often struggle with managing multiple clients, invoices, and expenses. QuickBooks simplifies this process by organizing financial data in one place, allowing freelancers to send invoices and get paid faster.

2. Retail Businesses

Retailers can benefit from QuickBooks’ inventory management system, which syncs with sales data to automatically adjust stock levels. This helps avoid stockouts and overstocking, improving profitability.

3. Construction Companies

Construction companies can use QuickBooks to track project expenses, manage payroll, and create job-specific reports. This ensures that projects stay on budget and clients are billed accurately.

4. Nonprofit Organizations

Nonprofits can use QuickBooks to track donations, manage grants, and generate reports for their stakeholders. The software’s tax preparation tools are also useful for ensuring compliance with IRS regulations.

5. E-commerce Stores

QuickBooks integrates seamlessly with e-commerce platforms like Shopify, tracking sales, inventory, and payments in real-time. This makes managing an online store much easier.

Comparison Table: QuickBooks Plans

| Feature | QuickBooks Simple Start | QuickBooks Essentials | QuickBooks Plus | QuickBooks Advanced |

|---|---|---|---|---|

| Invoicing | Yes | Yes | Yes | Yes |

| Expense Tracking | Yes | Yes | Yes | Yes |

| Payroll Integration | No | Yes | Yes | Yes |

| Inventory Management | No | Yes | Yes | Yes |

| Time Tracking | No | Yes | Yes | Yes |

| Users | 1 | 3 | 5 | 25+ |

| Pricing | $25/month | $50/month | $80/month | $180/month |

Where to Buy and How to Get Started with QuickBooks

If you’re ready to streamline your business finances, QuickBooks offers several plans tailored to different business needs. You can get started with a 30-day free trial on any of their plans. Here’s how to purchase:

- QuickBooks Simple Start – $25/month (best for freelancers).

- QuickBooks Essentials – $50/month (ideal for small businesses with employees).

- QuickBooks Plus – $80/month (includes inventory management).

- QuickBooks Advanced – $180/month (for growing businesses with complex needs).

Benefits of Using QuickBooks for Your Business

1. Automated Financial Management

QuickBooks takes the hassle out of managing your books by automating most financial processes, such as invoicing, expense categorization, and payroll.

2. Tax Compliance

By integrating with TurboTax and providing tax deduction tracking, QuickBooks makes tax season much easier. You can estimate your quarterly taxes and even file them directly through the software.

3. Improved Cash Flow

With features like automated payment reminders and flexible payment processing options, QuickBooks helps you get paid faster and stay on top of your cash flow.

4. Seamless Integration

QuickBooks integrates with hundreds of third-party apps, including Shopify, PayPal, and Amazon, allowing you to manage your entire business from one platform.

How QuickBooks Solves Common Business Problems

- Problem: Managing multiple invoices and tracking unpaid bills.

- Solution: QuickBooks offers an automated invoicing system that tracks unpaid invoices and sends reminders to clients.

- Problem: Payroll errors and tax miscalculations.

- Solution: QuickBooks’ automated payroll and tax features ensure compliance and reduce errors, making payroll processing smoother.

- Problem: Lack of real-time financial insights.

- Solution: QuickBooks provides real-time reports that allow you to track income, expenses, and profitability instantly.

Frequently Asked Questions (FAQs)

1. Is QuickBooks suitable for freelancers?

- Yes, QuickBooks Simple Start is designed specifically for freelancers and self-employed professionals, offering features like invoicing and expense tracking.

2. Can I track my inventory with QuickBooks?

- Yes, QuickBooks Plus and Advanced plans include inventory management features.

3. Does QuickBooks integrate with third-party apps?

- Yes, QuickBooks integrates with hundreds of apps like Shopify, PayPal, and Amazon, making it easy to manage your business operations in one place.

4. How much does QuickBooks cost?

- Pricing starts at $25/month for the Simple Start plan and goes up to $180/month for the Advanced plan.

5. Can I try QuickBooks before committing to a plan?

- Yes, QuickBooks offers a 30-day free trial for all of its plans, allowing you to explore the features before making a commitment.

By leveraging the powerful features of QuickBooks, you can streamline your financial management, save time, and grow your business more effectively. Don’t hesitate to try it out and see how it can transform the way you manage your business finances!

Read More:

- Best Apps for Independent Contractors in 2024: Boost Productivity & Manage Finances

- Design Manager vs Studio Designer: Which One is Right for Your Project?