Freshbooks Self Employed – As a self-employed professional, managing your finances can feel overwhelming. From invoicing to tracking expenses, you need a tool that simplifies the process. Enter FreshBooks, an intuitive accounting solution tailored for the self-employed.

This article delves deep into why FreshBooks is a must-have for freelancers, its benefits, and how it compares to similar tools in the market.

Why FreshBooks?

FreshBooks is designed specifically for individuals who work for themselves. Whether you’re a freelancer, contractor, or small business owner, this software provides all the tools you need to streamline your accounting processes. With FreshBooks, you can easily:

- Create professional invoices that reflect your brand

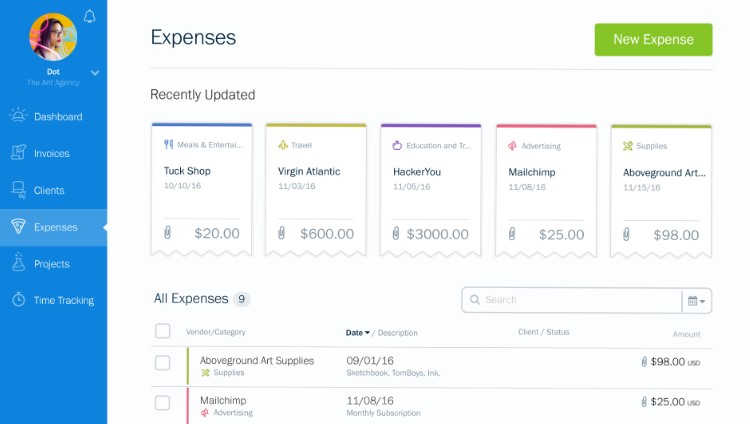

- Track expenses and connect to your bank accounts

- Generate reports to understand your financial health

- Collaborate with clients and track time for projects

Benefits of FreshBooks for the Self-Employed

Using FreshBooks as a self-employed individual brings several key benefits:

- User-friendly Interface – FreshBooks’ dashboard is clean, easy to navigate, and designed for non-accountants.

- Automated Invoicing – Automate repetitive tasks such as invoicing, following up on payments, and tracking time.

- Expense Tracking – Automatically categorize your expenses by connecting your bank and credit card accounts.

- Tax Preparation – Easily prepare your tax documents and file accurately with built-in tax reporting tools.

- Collaboration Features – Add clients and team members to specific projects, enabling real-time collaboration.

Real-world Product Comparisons

While FreshBooks is a leading option, it’s important to consider other solutions. Let’s compare FreshBooks to other popular accounting tools for the self-employed: QuickBooks Self-Employed, Wave Accounting, and Xero.

| Product Name | Use Case | Pros | Cons | Price (Monthly) | Features |

|---|---|---|---|---|---|

| FreshBooks | Freelancers, contractors | Easy invoicing, expense tracking, tax-friendly reports | Slightly higher pricing for premium plans | Starts at $17 | Invoicing, expense tracking, time tracking, collaboration |

| QuickBooks Self-Employed | Freelancers needing tax assistance | Strong tax prep features, connects with TurboTax | Lacks invoicing capabilities | Starts at $15 | Mileage tracking, tax estimation, TurboTax integration |

| Wave Accounting | Small businesses on a budget | Free to use, no-cost invoicing and accounting | Limited customer support | Free | Invoicing, accounting, receipt scanning |

| Xero | Small businesses scaling up | Highly customizable, many integrations | Complex setup for beginners | Starts at $13 | Invoicing, inventory management, expense tracking |

Product Details

- FreshBooks

FreshBooks offers comprehensive features that are ideal for self-employed individuals. Its invoicing tools are particularly notable for their customization, and the collaboration features help freelancers stay organized on projects.- Price: Starts at $17/month

- Key Features: Invoicing, expense tracking, project management, time tracking

- Use Case: Freelancers and contractors who need an easy-to-use accounting tool with great invoicing options.

- Buy FreshBooks: Click here to start with FreshBooks

- QuickBooks Self-Employed

QuickBooks Self-Employed is known for its powerful tax features, especially if you want integration with TurboTax for easy tax filing.- Price: Starts at $15/month

- Key Features: Mileage tracking, tax estimation, integration with TurboTax

- Use Case: Freelancers who prioritize tax preparation and filing.

- Buy QuickBooks Self-Employed: Click here to explore QuickBooks

- Wave Accounting

Wave is a great free alternative, providing essential accounting features without the price tag. It’s ideal for small businesses or self-employed individuals just starting out.- Price: Free

- Key Features: Free invoicing, receipt scanning, accounting tools

- Use Case: Budget-conscious freelancers or small businesses.

- Buy Wave Accounting: Start using Wave for free

- Xero

Xero is known for its powerful integration capabilities and is perfect for growing businesses looking for more advanced accounting features.- Price: Starts at $13/month

- Key Features: Inventory management, expense tracking, invoicing

- Use Case: Small businesses that need scalability and customization.

- Buy Xero: Get started with Xero

FreshBooks Use Cases: Solving Common Problems for Self-Employed

1. Managing Time and Invoices

Freelancers often struggle with tracking billable hours and creating professional invoices. FreshBooks solves this by allowing you to log time directly into the platform and convert that time into invoices with just a few clicks.

2. Tracking Expenses and Filing Taxes

The self-employed often find tax season stressful. With FreshBooks, you can easily categorize expenses throughout the year and generate detailed reports to simplify tax filing.

3. Staying Organized with Clients and Projects

Freelancers juggling multiple clients need a system to stay organized. FreshBooks offers project management features, enabling you to assign tasks, track progress, and communicate with clients all in one place.

4. Getting Paid Faster with Automated Reminders

Late payments are a common challenge for self-employed professionals. FreshBooks solves this by sending automated reminders to clients when payments are overdue, helping you get paid faster.

How to Buy FreshBooks (Transactional Section)

If you’re ready to simplify your accounting and take control of your finances, purchasing FreshBooks is easy:

- Visit FreshBooks’ official website: Go to FreshBooks

- Choose your plan: FreshBooks offers different plans depending on your needs. Plans start as low as $17 per month.

- Start your free trial: FreshBooks offers a 30-day free trial with no credit card required, allowing you to try out the features before committing.

FAQs

- Is FreshBooks good for self-employed individuals?

Absolutely! FreshBooks is tailored for freelancers, contractors, and small business owners with easy-to-use features like invoicing and expense tracking. - How much does FreshBooks cost?

Plans start at $17/month, with a 30-day free trial available. - Does FreshBooks integrate with other software?

Yes, FreshBooks integrates with popular tools like PayPal, Stripe, G Suite, and more. - Can I track time using FreshBooks?

Yes, FreshBooks allows you to track billable hours and link them to invoices. - How does FreshBooks compare to QuickBooks?

FreshBooks excels in invoicing and collaboration, while QuickBooks is strong in tax features and mileage tracking.

By choosing FreshBooks, you’re not just buying an accounting software—you’re investing in a tool that empowers you to grow your business and manage your finances effortlessly. Start your free trial today and experience the difference!

Read More:

- Best Independent Contractor Job Apps for 2024 | Work Smarter, Earn More

- The Ultimate Guide to Self-Employed Record Keeping: Top Tools, Benefits, and Best Practices